In this guide, I will provide merchants with a comprehensive overview of Decline Code 43 and how to effectively manage and resolve this issue.

Understanding Hold Codes

Hold codes are used by issuing banks to flag suspicious or potentially fraudulent transactions. Hold Code 43 specifically refers to a decline due to suspected fraud. Merchants should be aware that hold codes can vary depending on the card network, such as Visa, Mastercard, Discover, or American Express.

It is important for merchants to understand the implications of hold codes, as they can impact the approval or decline of a transaction. If you receive a Hold Code 43, it is crucial to contact the issuing bank for more information and to verify the transaction with the customer.

Merchants should also be proactive in preventing fraud by verifying the customer’s identity and payment card information before processing a transaction. Utilizing fraud prevention tools and staying informed about the latest fraud trends can help merchants protect their business and customers.

Navigating Stolen Card Situations

If you encounter a Decline Code 43 situation, immediately contact the issuing bank to verify the payment card details. Make sure to ask for the reason behind the decline and gather all necessary information. Provide any requested documentation to the bank promptly.

If the bank confirms that the card has been reported stolen or lost, do not proceed with the transaction. Instead, advise the customer to contact their bank to resolve the issue. Additionally, retain all transaction details for your records and follow any procedures outlined by your payment processor.

Triggers and Responses for Decline Codes

- Insufficient Funds: The customer does not have enough money in their account to cover the transaction.

- Expired Card: The card used for the transaction has passed its expiration date.

- Incorrect Information: The customer entered incorrect payment details, such as the wrong card number or CVV code.

- Suspected Fraud: The transaction triggered a fraud alert from the card issuer.

- Card Blocked: The card has been reported lost or stolen and has been blocked by the issuer.

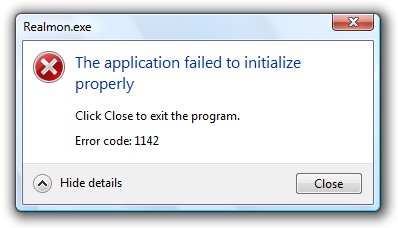

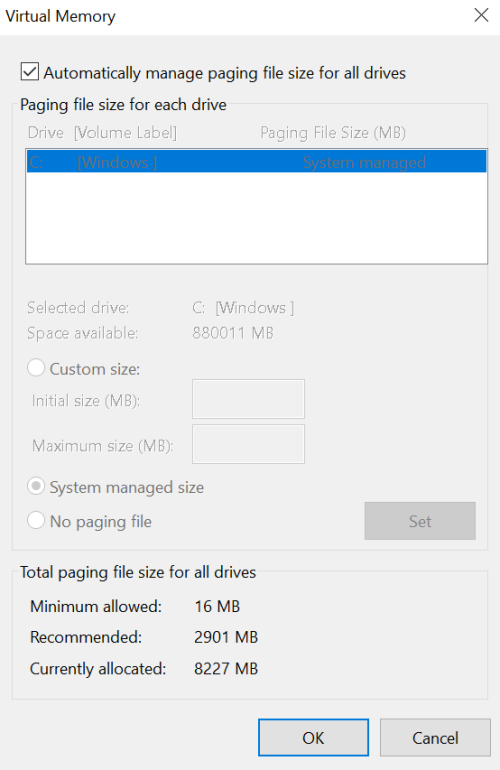

- System Error: There was a technical issue with the payment processing system.

Hard vs. Soft Declines: Knowing the Difference

When dealing with decline code 43, it’s important for merchants to understand the difference between hard and soft declines. Hard declines are typically due to issues with the payment card itself, such as an expired card or insufficient funds. On the other hand, soft declines are usually temporary issues that can be resolved, such as a network error or exceeded transaction limits.

It’s crucial for merchants to be able to differentiate between the two types of declines in order to effectively address the issue and provide a seamless payment experience for customers. Hard declines may require the customer to contact their bank or card issuer to resolve, while soft declines can often be resolved by simply reattempting the transaction.

Comprehensive Guide to Common Decline Codes

| Decline Code | Description |

|---|---|

| 43 | Stolen card |

| 51 | Insufficient funds |

| 61 | Exceeds withdrawal limit |

| 65 | Exceeds withdrawal frequency |

| 78 | Invalid card number |

Frequently Asked Questions

What is card decline code 43?

Card decline code 43 indicates that the card has been reported as stolen. This code flags the card for pickup by the issuing bank and prevents it from being used for transactions.

What is the response code 43?

Response code 43 indicates that the customer’s card has been reported as stolen.

What is the error code 43 on a Visa card?

Error code 43 on a Visa card indicates that the card has been reported stolen and the transaction has been blocked by the issuing bank.

What are the card decline codes?

The card decline codes include codes such as “Refer to issuer,” “Invalid merchant,” “Do not honor,” and “Pick up card (fraud).”